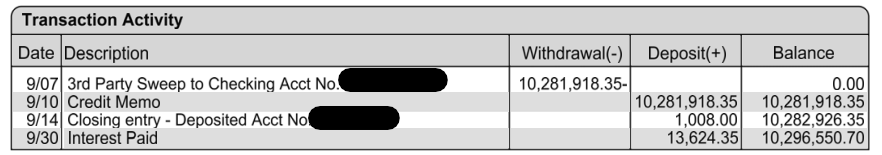

Recently, I stumbled upon a peculiar series of transactions in the September 2021 statement for the city of Bangor’s ARPA (American Rescue Plan Act) bank account.

Let’s break it down:

- The Sweep: On September 7, 2021, the entirety of the ARPA fund balance was transferred to another city account.

- Return and Credit: Three days later, on September 10, 2021, the full amount was returned to the ARPA account. A $1,008 deposit was added four days after that on the 14th. Per the Bangor City Manager, that was for interest earned for those three days.

- Unexpected Discrepancy: Using bank statements and the known ARPA account’s interest rate, the interest earned during September 2021 should have been $15,137.86. However, between the $1,008 deposit and $13,624.35 in interest paid by the bank… the city received only $14,632.35 – a $505.51 shortfall. (Not including $29.14 in compounded interest through May 10, 2024.)

- Seeking Clarification: I brought this to the City Manager’s attention, providing my supporting calculations. The response I received attributed the situation to a potential bank error.

Most of our accounts are zero balance accounts and are “swept” daily to a primary account. It would appear around this period the bank inadvertently “swept” the funds to the primary account and the $1,008 represents the interest earned on the funds while deposited in the primary account.

Debbie Laurie, Bangor City Manager, February 20, 2024 via email

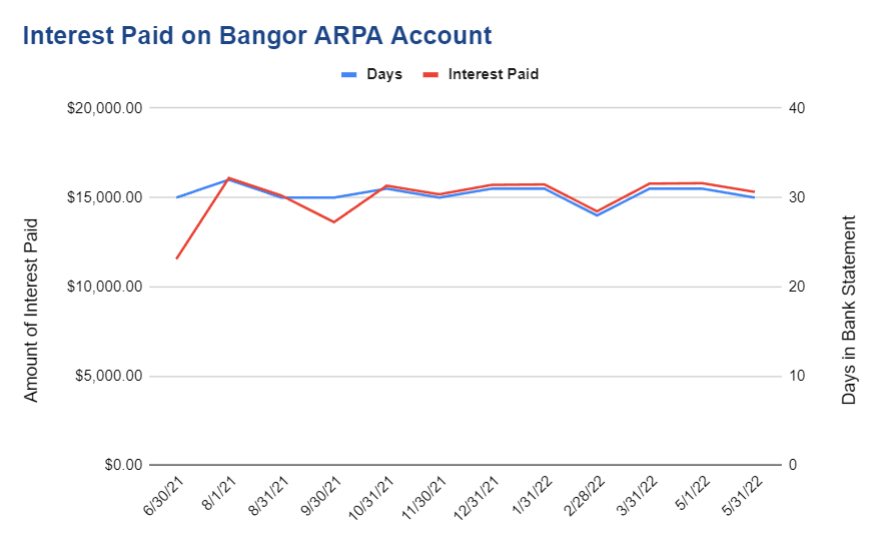

Sticks out like a sore thumb

The chart below shows the interest earned vs number of days in the statement for the City of Bangor’s ARPA account across the first 12 bank statement periods. When you look at the statement for 9/30/2021, you can see right away the interest was short. (The $1,008 credit for September 2021 is included.)

Lingering Questions:

If this was the result of a bank error, the bank didn’t make the city of Bangor whole after their mistake. Why only $1,008? How was that interest amount calculated?

This incident – coupled with recent findings by auditing firm Runyon Kersteen Ouellette about reconciliation – raises valid questions about account management and oversight.

Importance of Accuracy

The $505.51 discrepancy may seem small and insignificant when compared to a multi-million dollar account, but consider this:

Percentage-wise, it’s significant: A $500 difference on $10 million is a 0.005% discrepancy. But even a small percentage difference on a large sum can be indicative of a bigger underlying issue.

Catching bigger errors: Uncovering this discrepancy could lead to finding other, potentially larger errors in the bank’s calculations.

Building trust: By thoroughly investigating discrepancies, the city demonstrates responsible management of taxpayer funds.

Mistakes happen. To err is human. Having oversight controls in place is vital to catching these errors promptly. It’s worth noting that the City’s finance department has been vocal about staffing shortages for years.

The City Council must prioritize ensuring the department has the resources necessary to manage funds effectively and prevent future discrepancies.

UPDATE: In the April 22, 2024 City Council meeting, Finance Director David Little stated the Finance Department is now properly staffed.

Regarding the fate of the missing $505.51

I emailed the City Manager and City Council on March 6, 2024 to explain the discrepancy in detail. I have not heard back. The two scenarios:

- If this really was the bank’s error

- The city should contact the bank and show them the calculations.

- The bank, in the interest of maintaining a good relationship with the city, should credit the missing money. (I’d even argue they owe the additional $29.14 in compounded interest since then.)

- Likely the bank will say it’s been too long and cite corporate policy. That would be the end of it, as any further action would cost the city money (small claims court most likely) and we’d be throwing away good money after bad. A $534.65 lesson to the city in reconciling and watching your accounts closer.

- If this was an internal error at City Hall:

- How did we calculate the $1,008 before making the deposit?

- If it was done correctly, that means the account the money was swept into pays a lower interest rate than the ARPA account’s 1.79%. Why aren’t we sweeping funds into an account with the better interest rate? We’ve be losing revenue all this time.

- OR If the interest rate is the same in the other account, the ARPA account needs an additional deposit from the other account to make it whole.

- While the U.S. Treasury exempted recipients from reporting and remitting any interest earned on SLFRF funds, do this for the public trust.

- City Council stated publicly and allocated by resolve that all interest earned from ARPA funds would be used on ARPA eligible projects. Not some, not part… ALL interest earned.