Like many municipalities, Bangor, Maine has an unassigned fund. The Unassigned Fund is money that the City Council has not assigned to a specific purpose. The fund accumulates unspent appropriations as well as excess revenues. This fund serves as a contingency fund, giving the city protection again emergencies or unexpected shortfalls in revenue. It also gives the City Council flexibility to address unforeseen expenses throughout the fiscal year. It also contributes to the fiscal stability of the city as a healthy balance in this fund can positively impact the city’s credit rating.

What does Bangor do with an unassigned fund?

Typically the use it to fund the various reserve funds the City Council has set up. They do this by making an appropriation from the unassigned fund balance. The appropriation usually takes place after the budget is presented and is typically under $2 million, and it goes into reserves to fund equipment, improvements, and other capital needs throughout Bangor.

How much money has to be in the Unassigned Fund?

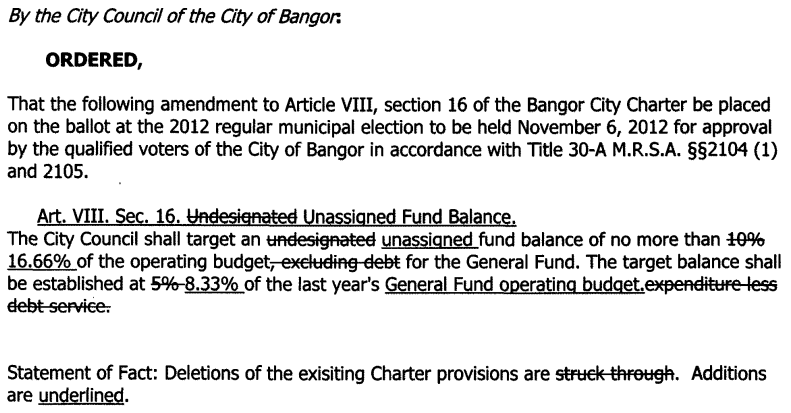

Per Bangor’s charter, the City Council must set a target of no less than 8.33% and no more than 16.66% of last fiscal year’s General Fund operating budget. (One and two months of expenses, respectively.)

Has it always been this way?

No. In 2012 Bangor voters approved an amendment to its Charter and renamed this fund from “undesignated” to “unassigned” and set a target and a cap for this fund. They also increased the minimum from 5% to 8.33%, and the cap from 10% to 16.66%.

This change also removed the requirement that debt service had to be factored in.

Where do we see the unassigned fund balance?

Each year the city of Bangor, Maine publishes a Comprehensive Annual Financial Report (CAFR) that informs both the City Council and the residents of the city about the state of the city’s finances as of the last completed fiscal year.

Bangor’s fiscal year covers July 1st through June 30th of the following year. The City Manager typically presents the report in December following the close of the fiscal year. (June 30, 2020 marked the end of Fiscal Year 2020, and the report was presented December 28, 2020.)

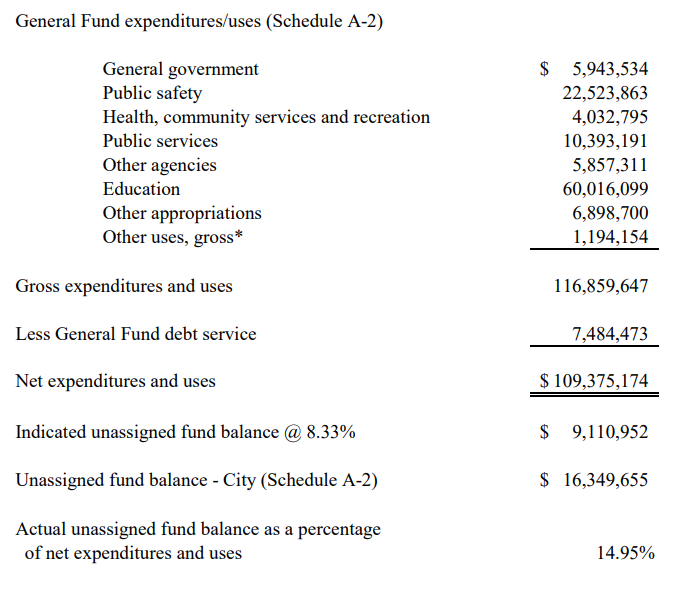

You can find the unassigned fund balance calculation worksheet as schedule F-2. Here’s the one from Fiscal Year 2022:

Why is debt service still being factored in?

Most likely due to §28-23, Paragraph A, Section 2, of the City’s charter that reads:

“In the performance of such duties, the Finance Director shall make the following calculation from the annual audit report to determine the general fund’s undesignated and unreserved fund balance: From the sum of general fund expenditures and uses, per Schedule A-2, subtract the general fund’s debt service, per Table 5.”

When the Unassigned Fund balance’s name and percentages changed in 2012, this was never amended. Being that the “undesignated” fund balance is the same fund, just with a new name, the city’s Finance Director is still bound by this.

The numbers on schedule F-2 for Fiscal Year 2022 are using the wrong numbers.

For some reason the the City used the actual expense numbers for Fiscal Year 2022 instead of the budget numbers, as required by the city’s charter.

Also, the “other uses, gross*” line, is odd. The asterisk message in the report states, “*excludes amounts appropriated from unassigned and assigned fund balance”. However there was also $8,372,000 in funds appropriated that weren’t factored in.

Last, the line for General Fund debt service doesn’t add up either. I can’t get any combination of debt service numbers throughout the report to add up to this amount. The closest I can come is from Table 5, as prescribed by the City’s Charter, and that amount adds up to only $6,301,668. So your guess is as good as mine. I can’t come up with any other combination of numbers in the FY 2022 report that adds up to what the city reported on Schedule F-2.

You can download a copy of Bangor’s Fiscal Year 2022 Comprehensive Annual Finance Report at the end of the article. You can also download copies of other fiscal years’ reports on the City of Bangor’s website.

So what is the current state of the Unassigned Fund? What percentage is it at?

There are two pieces to potentially look at. Finance Director is told to come up with the “undesignated and unreserved balance” with one formula using actual expenditures. The City Council is told to target an unassigned fund balance using budgeted numbers.

I would argue that the charter is speaking directly to City Council’s duty to target a balance, and the City Finance Director’s portion §28-23 does not apply, as the formula provided speaks directly to the Finance Director’s duties dictated by the charter. City Council is explicitly instructed to target a balance based on “the operating budget for the General Fund.”

For 2022 (the last reported fiscal year at the time of publishing this article), that General Fund Operating Budget was $110,891,966. (See Order 21-224)

For that amount, 8.33% should = $9,237,301

FY 2022 Annual Report’s 8.33% = $9,110,952

Unassigned balance for FY 2022 = $16,349,655

City reports that as 14.95% of general fund operating EXPENDITURES.

Based on Article VIII, Sec. 16 of the Charter, it actually should be 14.74% of the general fund operating BUDGET.

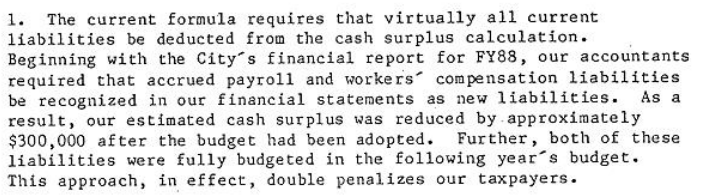

To include debt service or not

Based on the strict reading of the charter, the City Council is supposed to take . In fact, if you look at the changes from 2012, excluding debt service was specifically stricken from the charter, meaning it was the intent for debt service to be included, not excluded. The city, interprets the law differently, and continues to exclude debt service.

The argument AGAINST excluding debt service

If the entire point of having an unassigned balance is to have funding available to cover expenses in the event of a significant revenue shortage, then you would want to make sure you’re covering ALL expenses. that includes debt service. If the city misses a payment and ruins its credit rating, the long term costs to the taxpayers could be significant.

The argument FOR excluding debt service

As a taxpayer, the problem is we’d be getting penalized twice for the same debt. When the city of Bangor takes on additional debt, it’s the taxpayers that absorb that cost over the course of 20 to 30 years. If debt service is calculated as part of the determining the target for the unassigned balance, taxpayers would essentially be on the hook for BOTH the debt service AND the portion of the unassigned balance that increased because of the included debt service.

The double penalty issue is something Bangor’s City Manager in 1989, Edward Barrett, wrote about to City Council at time: